How we work

Many people have goals and dreams, but a goal without a plan is just a wish... an achievable goal is a dream with a deadline ...

Here's how we formulate the plan towards achieving your goals:

Phase 1 - About You

Firstly we have a discovery meeting at our cost, to discuss your personal circumstances and your current financial situation. What your goals and ambitions are for the future. We will discuss with you our process and how we can help you. We will also discuss our charges and services so you know exactly what you will be paying and what you get for your money.

Phase 2 - The Factfind

From the discovery meeting we will then with your agreement go into detail so that we can draw up a complete picture of where you are now, and where you want to arrive. We will ask about you, your occupation, your savings & investments, your mortgage, your current liabilities and your tax position, and we'll explain how all of this information builds into a profile which we will then match against your objectives and your aspirations. We'll discuss risk and reward, and ask you to complete an attitude to risk profiler to assertain your attitude towards investment risk (ATR), as this feedback from you will enable us to construct an investment portfolio which will match your present attitude to risk which will be reviewed at our annual servicing meeting to make sure your ATR is still in line with your investments. You will see as we move forward in our discussions how all this fits into place in your personal plan.

Phase 3 - Analysis

We will discuss with you our analysis of your current position, and an outline of our initial thoughts for your plan. We will present you with our recommendations and the actions required to make progress towards achieving your goals.

Phase 4 - How to get there

We now know where you are and where you want to be. In this phase we present your Personal Financial Plan which maps out the journey to your destination, and we establish the best and most time-efficient route to get you there. We discuss with you your current income and expenditure, your assets and liabilities, and how your existing finances can best be utilised towards the achievement of your financial goals. We will also disclose the full cost to you of implementing the Personal Financial Plan that will help you reach your objectives. At this point we ask for your approval and confirmation of the plan. Nothing happens without you having a full understanding of what we are trying to achieve for you.

Phase 5 - Implementation

It is now time to implement the plan. Every course of action we have recommended and agreed with you is now put into motion.

Phase 6 - Review the Plan & Progress Updates

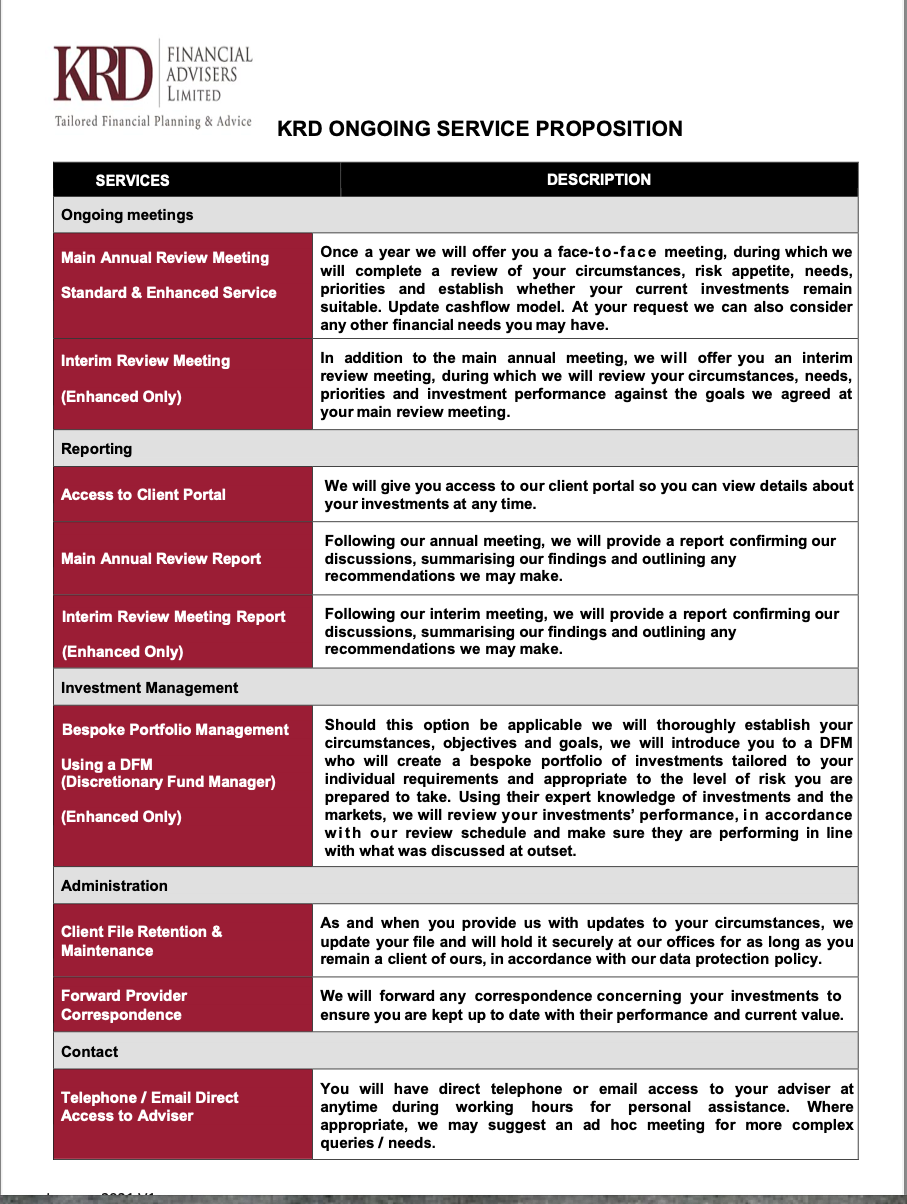

Review dates and service levels will be agreed, and should take place at least annually, and more regularly if required or requested. The purpose of regular monitoring of your Personal Financial Plan is to enable you to clearly see progress towards reaching your financial goals, and for us to make any adjustments that may be required. Working closely with you we will explain overall how the plan is going and agree with you any modifications to keep it on track towards the achievement of your goals....

Click below to view our service propositions